On May 15th, the PPP Loan Forgiveness Application was released. If you’ve been wondering how this application will work, this should help. This article compiles everything you need to know about the PPP Loan Forgiveness for Chiropractors. Here’s a high-level overview of what this post covers. To get more detail, keep scrolling

When was the PPP loan forgiveness application released?

This 11-page document was released on Friday, May 15th.

What is the deadline for PPP loan forgiveness applications?

Applications for loan forgiveness will not be accepted until 56 days after PPP disbursement has taken place. For most borrowers that means applying for loan forgiveness after June 30.

Can this PPP loan forgiveness application be used for chiropractic offices with multiple employees, single doctor offices, and contractors?

The PPP loan forgiveness application works universally for any type of chiropractic office. Including chiropractors who have multiple employees, single doctor offices, and contracted doctors.

What does the PPP application form look like?

The application itself is broken down into 3 sections. Only 2 of the 3 sections of this loan forgiveness paperwork are required by chiropractors who only pay themselves as employees.

What documentation will chiropractors need to provide for the PPP loan forgiveness application?

Mortgage Interest Payments -Lender amortization schedule and receipts from payment, Business Rent or Lease Payments – Copy of your current lease agreement and receipts or canceled checks, Business Utility Payments – Copy of invoices and receipts paid.

Payroll Documentation – If you are a single employee no additional paperwork is needed. If you have employees other than yourself, you will need to make sure the PPP Schedule A Worksheet section of the application is filled out accurately.

When will borrowers know if their application for PPP loan forgiveness has been approved?

Lenders must make a decision on forgiveness within 60 days.

When was the PPP loan application released?

The PPP Loan Forgiveness application allows businesses to have the money borrowed through the PPP Loan completely forgiven, IF it was used correctly. it is not automatically forgiven. Payroll is the #1 use for the money. In order for the money to be forgiven, it must be used in an 8 week period, dependent on the date you received the loan money.

Watch the video for more details and a break down of the application.

The 11 page PPP loan forgiveness application was released last Friday, giving the majority of chiropractors everywhere some time to digest what will be needed to apply for complete loan relief from money lent as a result of the Paycheck Protection Program that was signed in late March.

In general, this forgivable loan program was intended for small businesses (such as most chiropractic offices) to aid them in covering employee payroll costs, mortgage, interest, rent, & utilities. Accuracy of this loan relief application is critical in ensuring the full amount is forgiven for all eligible uses of the loan.

What is the deadline for PPP loan forgiveness applications?

Applications for loan forgiveness will not be excepted until 56 days after PPP disbursement has taken place. For most borrowers that means applying for loan forgiveness after June 30.

*** It is important to note that the SBA may limit this timeframe but no further information has been released yet.

Can this PPP loan forgiveness application be used for chiropractic offices with multiple employees, single doctor offices, and contractors?

The PPP loan forgiveness application works universally for any type of chiropractic office. Including chiropractors who have multiple employees, single doctor offices, and contracted doctors.

For chiropractors who have multiple employees, the form does get a little more complicated. More on that below.

What does the PPP application form look like?

The application itself is broken down into 3 sections. Only 2 of the 3 sections of this loan forgiveness paperwork are required by chiropractors who only pay themselves as employees.

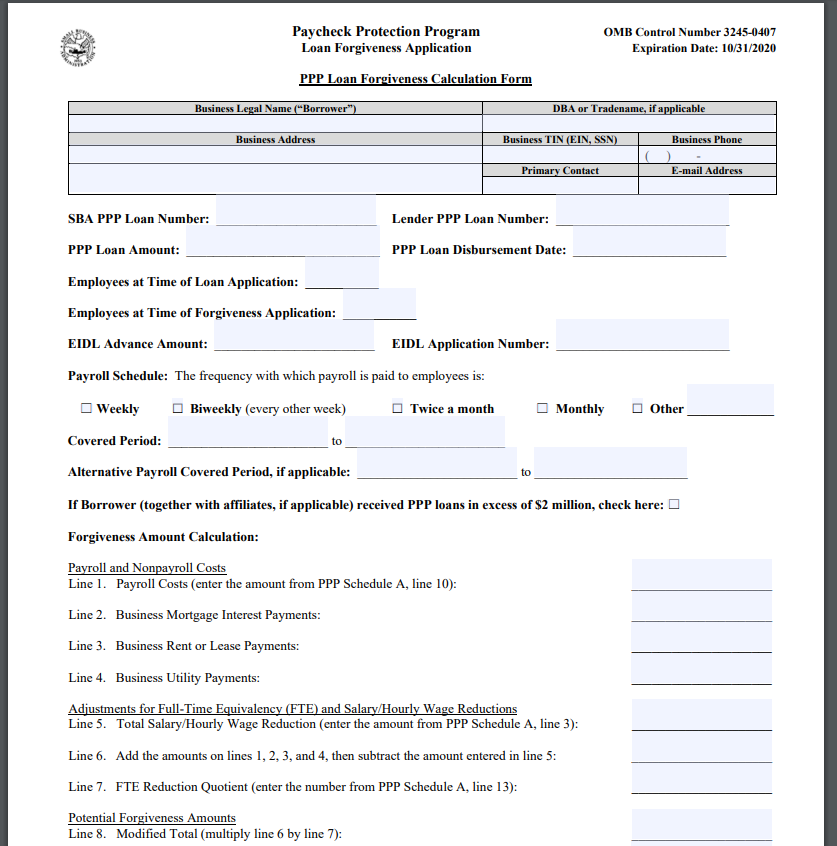

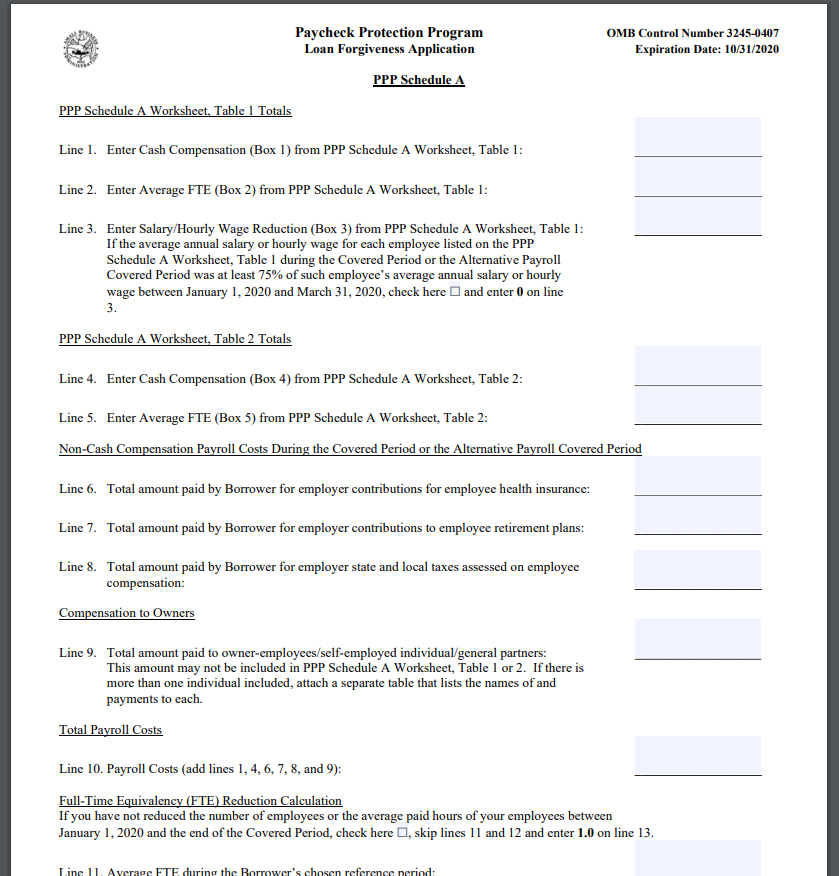

Part 1: PPP Loan Forgiveness Application Form (Used by all applicants)

Part 2: PPP Schedule A (Used by all applicants)

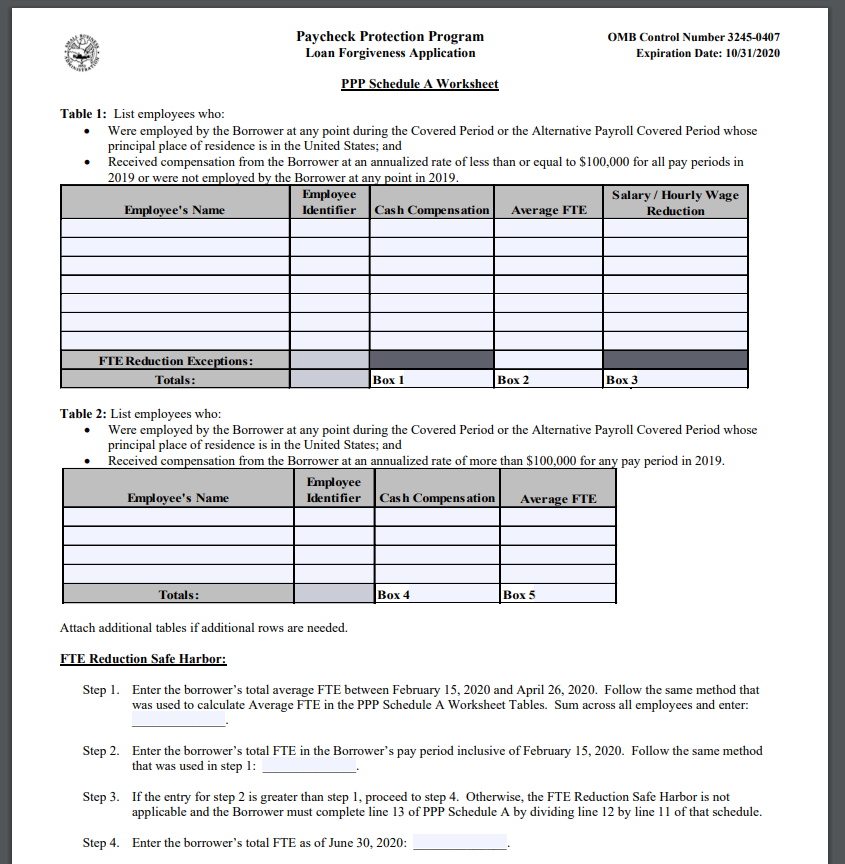

Part 3: PPP Schedule A Worksheet (Only used for business owners with employees)

What documentation will chiropractors need to provide for the PPP loan forgiveness application?

NOTE: Keep this paperwork somewhere safe because if your application is approved, an authorized SBA representative can request access to it up to 6 years after the loan is repaid in full.

PPP Loan Forgiveness Live Q&A Recording - Answering Chiropractor's Questions About The Application

The PPP Loan Forgiveness application isn’t as straight forward as one would think it would be. I hosted a Facebook Live to answer questions about the PPP Loan Forgiveness application. It covered payroll reductions, the fact that you get to choose between the covered period or the alternative payroll cover period, how non-payroll expenses 8 week period starts right when you receive the money.

Here are the questions I answered:

- Will they include my share holder distribution as part of my total payroll that will be forgiven? How do we do the EIDL grant and the PPP?

- What if you have an employee that doesn’t want to come back?

- What if you only have the doctor on insurance?

- Are bonuses allowed?

- June 30th, do we have to run a payroll by then or just have people back to work by then?

- If they extend it to 16 weeks, can we halt our payroll for 2 more weeks until we can reopen?

- & more!

Watch the video for the answers and more specific information about the PPP Loan Forgiveness application.

What Payroll Costs Qualify For The PPP Loan Forgiveness Application?

When applying for PPP loan forgiveness, it is important to know what cost will be covered and what is not. Non-payroll costs can only make up 25% of what you’re asking to be forgiven.

In this video, I walk through what you can claim forgiveness on and how much, dependent on your money received. To help, I use my practice for you guys to have an example.

When applying for PPP Loan Forgiveness, it is important to know what cost will be covered and what is not. Non-payroll costs can only make up 25% of what you’re asking to be forgiven.

In this video, I walk through what you can claim forgiveness on and how much, dependent on your money received. To help, I use my practice for you guys to have an example.

Which 8 Week Time Frame Is Best To Use For The PPP Loan Forgiveness Application? Covered vs. Alternative Payroll Covered Period.

When applying for PPP Loan Forgiveness, it is important to know what cost will be covered and what is not. Non-payroll costs can only make up 25% of what you’re asking to be forgiven.

In this video, I walk through what you can claim forgiveness on and how much, dependent on your money received. To help, I use my practice for you guys to have an example.

Which 8 Week Time Frame Is Best To Use For The PPP Loan Forgiveness Application?

Once you receive the PPP loan, your payroll should be covered to an extent. The covered period is easy. The day you receive your money, you have 56 days until the period is up. The alternative covered payroll period is an option you can choose if you received the money in between a payroll date.

Watch the video for more details and specific examples from my businesses on the covered period vs the alternative covered payroll period.

If you have any questions about the PPP Forgiveness Loan application as it applies to your chiropractic office, please reach out to me on my social channels.